Generate Your Own Equity Micro-Bank That Compounds Your Money With the Right Capital Structure!

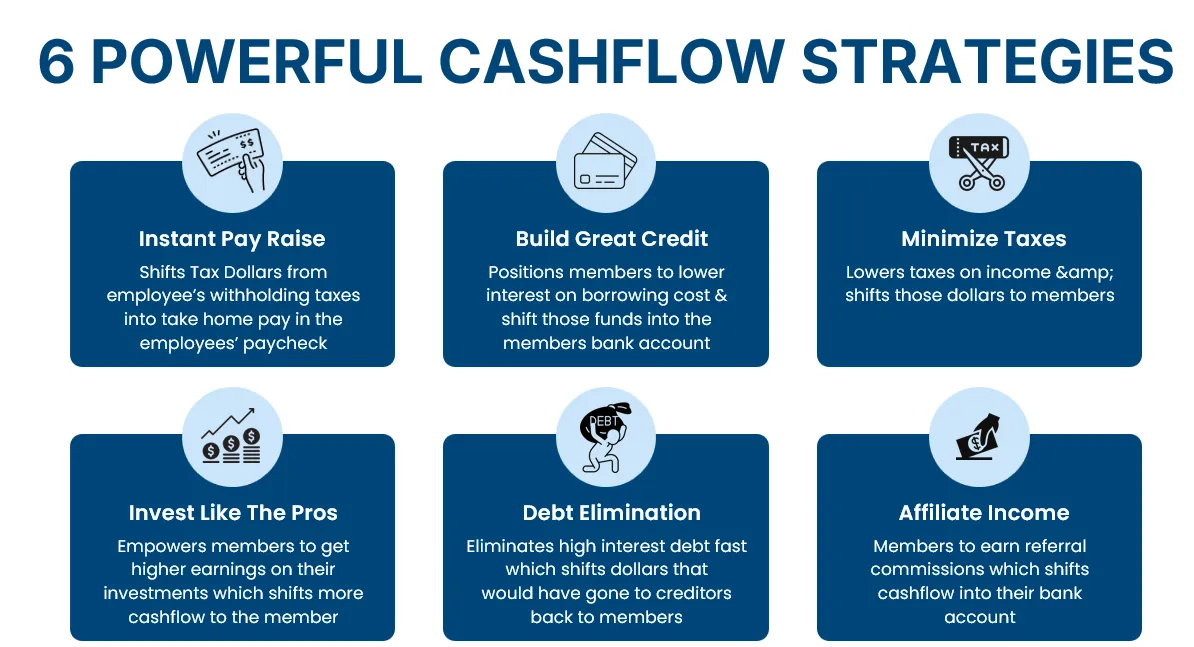

Amplify Your Earnings with 'The New Rules of Banking'! Ignite Your Finances with 6 Essential Strategies That Adds An Income Producing Asset To Your Balance Sheet. Create Your Personal Equity Compound Account With Interest & Watch Your Working Capital Grow Exponentially!

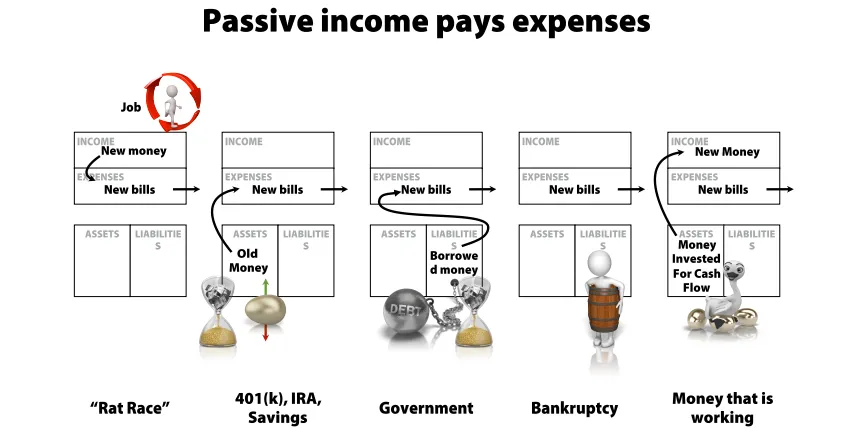

Most households are stuck being on the wrong side of the balance sheet! We made it simple: there is just one step to take to begin Your New Banking Journey.

Investing Money Versus Growing Money

The key takeaway is to focus on growing your money first through active management and strategic movement before committing it to specific investments. This approach allows you to accelerate your financial growth and optimize the returns from your investments

Investing Money

Investing Money means Putting your funds into an asset, such as stocks, real estate, or bonds. Each asset has its own inherent growth rate, which determines the speed at which your money increases. This growth rate is largely beyond your control and is influenced by market conditions, the performance of the asset, and other external factors. Essentially, when you invest money, you are tying the growth of your money to the structure and performance of the asset you have chosen.

Growing Money

Growing money, on the other hand, is a dynamic process

that involves strategically moving your funds to maximize growth. This approach leverages the concept of Velocity of Money, where the speed at which money circulates and is utilized can be influenced by your actions. Unlike investing, growing money is not tied to any one asset but rather focuses on a continual process of reallocating funds to take advantage of opportunities, compounding benefits, and optimizing returns. By Actively managing the flow of your money, you have greater control over its growth rate.

Compound An Income Producing Asset On Your Balance Sheet with an Exclusive Capital Structure. Add Daily Working Capital That Creates A Velocity Growth Engine Positioning Your Money in the Right Sequence!

Hyper - Compounding: The Velocity Growth Engine

This is the part that frustrates most of our members when they discover the truth: the dark secret of financial institutions.

We've all been sold the magic of compound interest. It's the story they fee to the masses:

'"The magic of compound interest: Earn a return, reinvest it repeat. The Magic will happen."

Yes it works - but mostly for them. They aren't building empires on compound interest... instead they're using compound growth

$8,000 Vs $108,000

Lets say you invest $100,000 that generates an 8% return ( $8,000 by end of year one). You've heard it "Compound interst is the 8th wonder of the world."

Most investors believe:

* "If I keep compounding that at 8%, I'm set."

* "As Long as I beat inflation, I'll be okay."

But if your $100,000 grows at 8% ($8k in the first year) while your Freedom Number - the cost of your ideal life - is growing by $100,000/year, you're falling behind. Especially if you start with modest capital.

Compound interest alone is too slow for today's moving finish line - unless you are starting with a large sum of capital. To make compounding work you need to multiply your capital invested (the $100,000 in our example) and harness the power of velocity in every move.

Would you rather compound ($8,000 in our example) takes forever. Compounding a larger number ($108,000 in our example) Multiplies your results and cuts down your time to your goal. This is the difference between compound interest and compound growth - and why Hyper- Compounding is the engine that makes the System work.

Compound Interest vs Compound Growth

Compound Interest - Reinvests only your returns. In our $100,000 example, it's focused on growing the returns ($8,000) only. This is Layer 1: Compound interest - one - dimensional, slow, and exactly what banks want you to focus on.

Compound Growth - Grows both the original capital ($100,000) and the returns ($8,000) every cycle. This is Layer 2: Compound Growth - multi - dimensional, fast, and in fact the way banks and the wealthy actually build wealth. The results are staggering

In Just 5 Days; "Master The New Rules of Banking" Becoming Your Own Equity Micro Banker"!

Day 1 -Create Your Equity-Banking Blueprint: Safeguard Your Current Assets & Increase Your Income Simply by Knowing & Positioning Your Numbers Correctly.

Day 2-Customize Your Equity-Banking Blueprint:

Why Our Equity-Banking Blueprint Dominates The Traditional Financial Plan So your money starts working for you.

Day 3-Unlock Your Equity-Banking Scorecard: Plug Financial Leaks & Recover Cash! With Your Own Customized Plan & Will Capture Lost Money—Typically in Just 72 Hours to See Results!

Day 4-Engineer Your Equity-Banking Blueprint: Reduce the cost of money daily so your Income Producing Asset Pays your Current Expenses. This New Income Generating Asset Accelerates The Banking Process to See Results in 3 to 7 years Instead of the typical 30 years without changing your Monthly Budget

Day 5-Automate Your Equity-Banking Process:

Our Effortless 'Set-and-Forget' Strategy - Self Funds An Income Producing Asset So Your Wealth Ladder System Captures & Grows Your Income Every Year Automatically

Bankers Bonus Velocity Growth Engine - This Strategy Session Adds Fuel to Your Balance Sheet Accelerating Time Value of Money!

I Have A Blueprint For Developing Your Own Equity Compound Account

Add Daily Working Capital Back On Your Balance Sheet!

See what Our Members are saying About Equity Micro Banking!

Real Numbers. Real Savings.

With Your Course I can expect to pay off my home in 7.33 years saving a total of $86,457.09 with an effective interest rate of 1.312% & a Note Rate of 4.75% a on my existing mortgage. The projected growth of a future investment account that is funded using the discretionary income available once the mortgage balance is paid in full will be $461,562.23

Janet Kennerson

Real Numbers. Real Savings.

With Your program I can expect to pay off my home in 10.42 years and save a total of $166,468.49 with an effective interest rate of 3.529% & a Note Rate of 7.25% on my existing mortgage. The projected growth of a future investment account that is funded using the discretionary income that is available once the mortgage balance is paid in full will be a staggering $452,454.58

Greg Moreland